Benefits

Invisible verification A smooth shopping experience for your customers.

Increase revenue VzPay Payment saves transactions that would have been declined.

Full automation Cut operational costs and scale instantly to meet your needs.

Higher approval rates Cutting edge technology maximizes your revenue.

100% chargeback guarantee No more unexpected losses from fraud related chargebacks. (*option available after analysing current client performance.)

Customer satisfaction Frictionless shopping that keeps customers coming back.

Stop Losing Revenue

Customer friction 84% of eCommerce customers abandon there cart.

Bank declines 8% - 16% of orders are declined by the bank - a $340B loss.

Overhead Merchants emoloyee huge teams to manually review orders and maintain tools.

False declines $200B lost to incorrectly declined customers.

Chargebacks Merchants lose $50B to chargebacks.

Customer lifetime value Frictionless shopping that keeps customers coming back.

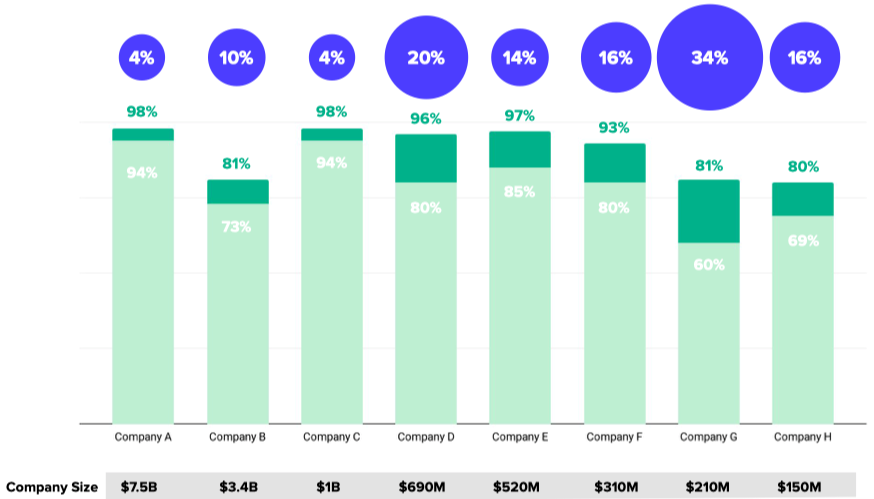

Client result

Sales growth after VzPay

Approval rate after VzPay

Approval rate before VzPay

Management summary

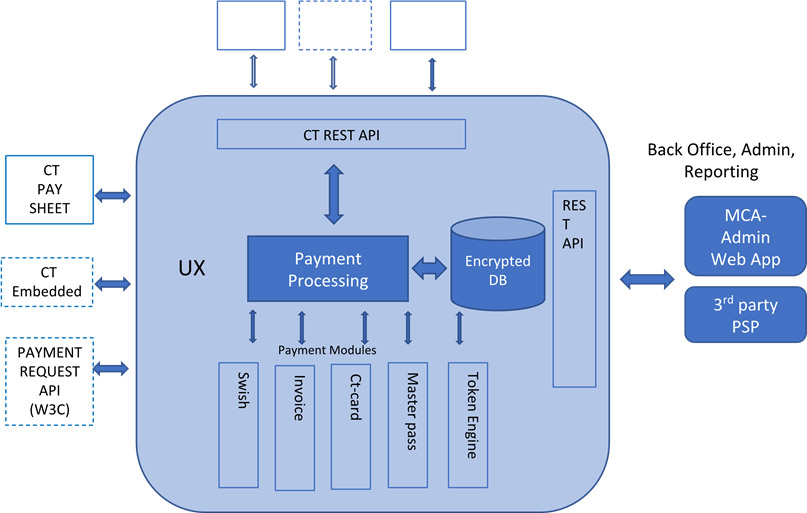

VzPay Payment can provide a simple and business driven payment solution for both low and high risk merchants

• Short Time to Market. Integration and merchant boarding can be done via well defined APIs and lean business processes

• Flexible Pricing enables us to be competitive in the tough market.

• Straight forward business and operating model enables effectice approach towards the merchants.

Features

• Simple and hassle free merchant boarding

• Smooth single page Checkout

• Support for Visa and Mastercard also via Masterpass and Apple Pay*

• Alternative Payment methods for the Nordic (Swish, Direct Bank payments, Consumer Finance) Support Multiple Purchase a settlement currencies

• Back Office functionality including dash board and fraud management

• Quick and easy to add new acquirer connections and switch between acquirers

Target Customers

Our services suit well both for low- and high-risk merchants.

A high risk merchant account is a payment processing account for businesses that are classified as high risk by acquirers/banks such as airplane tickets, online services, gaming, gambling, cryptocurrencies and insurance products etc.

We help high risk merchants to find the right payment portfolio for their business. This can be to connect with right acquirer or to use alternative payment methods like vouchers and prepaid cards. Anyway, we find the way to get paid.

Solution

• Based on open source architecture (LAMP) and hosted by 24Solutions AB.

• PCI DSS Level 1

• Multicurrency and main languages support

• Card payments (3D/No secure)

• One Click payments

• Recurring Payments for subscriptions and services

• Instant Payments

• Token Engine

• Dashboard for reconciliation and reporting

• Fraud management tools

• CT White label PSP is designed for partners and 3rd party PSP's

• API based merchant boarding and administration

Short Time to Market

• Easy integration via well defined REST API's and online integration support

• Simple and hassle free merchant boarding

• Scalable and cost effective services

Payment Portfolio

- Visa

- American Express

- Discover

- Apple Pay

- Masterpass

- MasterCard

- Vipps

- Swish

- MobilePay

- Clearhaus

- Bambora

- Elavon

- Handelsbanken

- Swedbank